This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page.

I often get asked, “What are the best credit cards for travel miles?” Fortunately, airline miles credit cards have many rewards and perks, giving travelers plenty of worthy options. Since I’ve redeemed travel miles for trips around the world I wrote this post from my personal experience to help break down the options to help you find the best miles credit card for your lifestyle. The best credit cards to earn travel mileage in 2024 come with benefits that elevate your travel experience and come with large bonus offers, like the 75,000 point offer on the Capital One Venture Rewards Credit Card.

See The Best Miles Credit Card Offers in 2024 Below:

- Best overall $750 in award travel: Chase Sapphire Preferred® Card

- Best Miles Credit Card 75k mile bonus: Capital One Venture Rewards Credit Card

- 60k Points Offer: American Express® Gold Card

- Best Luxury Credit Card: The Platinum Card® from American Express

- Airline Credit Card for Incidental Fees: Chase Sapphire Reserve®

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

What Credit Card Gives the Most Mileage?

The credit cards below give you the most miles and are best for mileage.

| Credit Card | Category | Annual Fee | Recommended Credit Score | More Information |

|---|---|---|---|---|

| Chase Sapphire Preferred® Card | Best travel cards for beginners | $95 | 700 | More info |

| Capital One Venture Rewards Credit Card | Best miles credit cards | $95 | 700 | More info |

| The Platinum Card® from American Express | Best airline miles credit card premium | $695 (See Rates & Fees) | 700+ | More info |

| Chase Sapphire Reserve® | Best airline credit card for incidental fees | $550 | 780+ | More info |

| Ink Business Preferred® Credit Card | Best business credit cards | $95 | 700+ | More info |

| Avianca Lifemiles credit cards | Best air miles credit cards | $59 | 670+ | More info |

Travel benefits include free checked bags (usually for you and your companions), priority boarding, lounge access, and more. Better yet, some miles credit cards are not co-branded with a specific airline, so you can enjoy having flexibility when determining who you want to fly with. You’ll earn points/miles that can be transferred to several airlines.

If you want to maximize your credit card sign-up/welcome bonus, travel mileage, and everyday spending to earn the most valuable rewards and bonuses, here are the best credit cards for travel mileage for 2024.

The Best Credit Cards For Travel Miles 2024

Chase Sapphire Preferred Card – $750 Award Travel Bonus Offer, Rewards on Dining, Travel, And More

If you’ve been considering going for the best miles credit card to start 2024 that gives you awesome benefits, fantastic travel rewards, and a great sign-up bonus, there’s no need to look further than the Chase Sapphire Preferred® Card.

New Chase Sapphire Preferred® Card cardholders can earn 60,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening. That’s $750 when redeemed through Chase Ultimate Rewards®. Member FDIC

This card also has some of the best travel protection of any card on the market.

When you redeem your points through Chase’s Ultimate Rewards portal, you’ll be getting 1.25 cents for each point on car rental, airfare, hotel, cruise, or other activity booked in the portal. This is one of the best exchanges on the marketplace, and remember you can get even more value by transferring your points out to a travel partner. This is how you can turn your Chase Ultimate Rewards points into airline miles.

Chase has some of the most popular rewards cards available today. The sign-up bonuses are industry-leading, and their perks are top-notch. Plus, Ultimate Rewards points are some of the most flexible points you can earn.

60,000 points bonus: Chase Sapphire Preferred® Card

Chase Sapphire Transfer Partners

There are several Chase airline transfer partners:

- Aer Lingus

- Air Canada

- British Airways

- Emirates

- Air France KLM

- Iberia

- JetBlue

- Singapore Airlines

- Southwest Airlines

- United

- Virgin Atlantic

There are also 3 hotel transfer partners:

- IHG Rewards

- Marriott Bonvoy

- World of Hyatt

As you may note from the list of partners and the lack of foreign transaction fees, this card is one of the best for international travel.

Chase Sapphire Preferred Benefits

Did we mention travel benefits? The list of benefits you’ll gain when you sign up for the Chase Sapphire Preferred card goes on and on. The Chase Sapphire Preferred® Card can be used around the world, and you won’t incur any foreign transaction fees.

Saving that 3% on each foreign purchase will save you a lot of money and keep you from running back to the ATM for more cash.

The Chase Sapphire Preferred earns unlimited:

- 5x points on travel purchased through Chase Ultimate Rewards® (excluding hotel purchases that qualify for the $50 Anniversary Hotel Credit)

- 3x points on dining (including eligible delivery services, takeout, and dining out)

- 3x points on online grocery purchases (excluding Target®, Walmart®, and wholesale clubs)

- Also 3x points on select streaming services

- 2x points on all other travel purchases

- 1x point per $1 spent on all non-bonus purchases

There is a $50 annual Ultimate Rewards Hotel Credit. It comes in the form of a statement credit that will automatically be applied to your account when your card is used for hotel accommodation purchases made through the Ultimate Rewards program, up to an annual maximum accumulation of $50.

Plus, on each account anniversary, you’ll earn bonus points equal to 10% of your total purchases made the previous year. So, if you spend $25,000 on purchases, you’ll get 2,500 bonus points.

So yes, we think the Chase Sapphire Preferred is worth it in 2024.

Whether you’re booking flights, renting a car, booking a hotel room, or taking a taxi, you’ll be earning points.

Insurance Protections

Along with all of your spending benefits on travel, you get travel protection. This includes trip cancellation and interruption insurance, rental car damage insurance, travel accident insurance, lost luggage reimbursement, trip delay reimbursement, and baggage delay reimbursement. That’s a lengthy list of travel protection goodness. Chase Sapphire Preferred® Card also offers users purchase protection, warranty protection, price protection, and return protection on other purchases.

To top all of these benefits off, Chase Sapphire Preferred gets you access to a customer service agent 24/7. You get to talk to a live person without going through a phone tree. Imagine that.

The $95 annual fee isn’t waived for the first year, but the bonus and benefits certainly justify the fee. In my opinion, this is the best credit card for travel miles.

Here’s the credit score you’ll need for the Chase Sapphire Preferred.

You may have noticed that the Chase Sapphire Preferred and the Capital One Venture Rewards Credit Card have many similarities (2x rewards (on select purchases for the Preferred), a $95 annual fee). Check out this post to see how the Chase Sapphire Preferred and Capital One Venture compare and which might be better.

60,000 points bonus: Chase Sapphire Preferred® Card

Capital One Venture Rewards Credit Card – 75k Bonus Offer, TSA PreCheck or Global Entry Credit, 2x Miles

The Capital One Venture Rewards Credit Card comes with the ability to earn 2x miles on every purchase. However, earn 5x miles on hotels and rental cars booked through Capital One Travel.

Plus, get a fee credit of up to $100 for TSA PreCheck or Global Entry. There is a $95 annual fee. Plus, you can transfer your miles out to leading travel partners and enjoy Capital One’s airline lounges.

At 2x airline miles on every purchase (with each mile worth 1 cent), you’re essentially earning 2% back in rewards. When it comes time to redeem your miles, you’ll have two options:

- Redeem your miles as a statement credit against travel purchases

- Use your miles to book travel through Capital One

You can also make partial redemptions with no redemption minimum. That means you’ll be able to take full advantage of all of your rewards, no matter how few you have. And, as a bonus, your miles won’t expire. For travel miles cards, redemption options don’t get much more flexible or straightforward than this. For these reasons, the Venture Rewards made it to the best Capital One credit cards.

Capital One Transfer Partners

The Capital One travel transfer partners include:

- Aeromexico

- Aeroplan (Air Canada)

- Avianca

- Cathay Pacific

- Emirates

- Etihad

- EVA Air

- Finnair

- Air France KLM

- Qantas

- Singapore

- TAP Air Portugal

- British Airways Avios

- Turks Airlines Miles and Smiles

- Accor Live Limitless

- Choice Hotels (Choice Privileges)

- Wyndham Rewards

The Capital One Venture review exemplifies in detail why this might actually be Capital One’s most popular card, thanks to its easy-to-use rewards and valuable sign-up bonus.

The Capital One Venture Rewards Credit Card and Capital One VentureOne Rewards Credit Card ($0 annual fee option) are popular choices for many travelers. Their ease of use, uncomplicated earnings potential, and simple redemption methods make them attractive options.

Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel, with the Capital One Venture Rewards Credit Card.

Chase Sapphire Reserve – $300 Annual Travel Credit, 50% Travel Redemption Bonus

The Chase Sapphire Reserve® isn’t one of the best travel credit cards for beginners, but it’s one of the best credit cards for miles and premium perks. Its 50% travel redemption bonus makes the ongoing signup bonus worth more in award travel because each point is worth 1.5 cents each. This is one of the highest redemption values for credit card reward points.

New Chase Sapphire Reserve® cardholders can earn 60,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when redeemed through Chase Ultimate Rewards®.

Chase Sapphire Reserve® purchases earn up to 10x Ultimate Rewards. Cardholders can earn unlimited:

- 10x total points on hotels and car rental purchases through Chase Ultimate Rewards (after the first $300 is spent on travel purchases annually)

- 10x total points on Chase Dining purchases with Ultimate Rewards

- 5x total points on flights when you purchase travel through Chase Ultimate Rewards (after the first $300 is spent on travel purchases annually)

- 3x points on other travel worldwide (after the first $300 is spent on travel purchases annually)

- 3x points on other dining at restaurants, including eligible delivery services, takeout, and dining out

- 1x points for all remaining purchases

You will not receive rewards points on your first $300 in annual travel purchases as the annual travel statement credit reimburses these purchases.

There are also zero foreign transaction fees.

Bonus Chase Sapphire Reserve Rewards

The 50% bonus is great, but you might find more value with the 1:1 Chase Ultimate Rewards transfer partners (the same ones listed above). These airlines offer low-priced award flights, and they don’t charge crazy fuel surcharge fees that other carriers tack onto “free” award tickets.

When your points are worth more than 1.5 cents each by transferring them to an airline, pursue this option.

Besides getting more mileage from each reward point, you can also save money with the annual $300 travel credit, free Global Entry or TSA PreCheck, and Priority Pass Select membership. These are just some of the many perks of the Chase Sapphire Reserve which make it one of the best miles credit cards.

The annual fee is $550 but is easily offset by the Chase Sapphire Reserve’s perks. This is the credit score you’ll need for the Chase Sapphire Reserve.

American Express Gold Card – 4x Points on Dining; 60,000 Points Bonus Offer

The American Express® Gold Card is an American Express option to consider.

American Express Gold Card cardholders earn 4X Membership Rewards® points at restaurants, plus takeout and delivery in the U.S., and earn 4X Membership Rewards® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X). Plus, earn 3X Membership Rewards® points on flights booked directly with airlines or on amextravel.com.

Another perk is the ability to earn up to $10 in statement credits on a monthly basis when you use your Gold Card to pay at the following dining establishments (enrollment is required):

- Grubhub

- The Cheesecake Factory

- Goldbelly

- Wine.com

- Milk Bar

- Shake Shack (only at participating locations)

This perk can save you up to $120 annually.

There are also no foreign transaction fees to worry about, but the annual fee is $250 (See Rates & Fees), which can easily be offset by the perks of this card.

New American Express® Gold Card cardholders can earn 60,000 Membership Rewards® points after spending $6,000 on eligible purchases within the first 6 months. New cardholders can choose between Gold or Rose Gold. Terms apply.

The Capital One Venture X Rewards Credit Card – Best for Unlimited Miles Earning on Purchases, 75k Miles Bonus Offer

Another Capital One option that you don’t want to miss is the Capital One Venture X Rewards Credit Card that earns unlimited:

- 10x miles on hotels and rental cars booked through Capital One Travel

- 5x miles on flights booked through Capital One Travel

- 2x miles on all other purchases

Additionally, you can get 10,000 bonus miles every year, starting on your first anniversary. This is equal to $100 towards travel. You can use your miles to help pay for travel expenses or to transfer them to one of the Capital One travel transfer partners.

Another benefit cardholders can enjoy is $300 back annually for bookings through Capital One Travel.

If you’re interested in airport benefits, note that the Venture X Rewards also come with a fee credit of up to $100 for TSA PreCheck or Global Entry as well as Capital One lounge access and Priority Pass lounge access.

Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel, with the Capital One Venture X Rewards Credit Card.

The annual fee is $395, and there are no foreign transaction fees.

The Platinum Card from American Express – Best Credit Card for Airline Purchases, 80,000 Bonus Points Offer

You would think that co-branded airline credit cards pay the most travel miles for airfare purchases. That’s not the case. The Platinum Card® from American Express is one of the best credit cards for airline miles and the best credit card for flight tickets.

New The Platinum Card® from American Express cardmembers can earn 80,000 Membership Rewards® points after spending $8,000 on purchases on their new Card in the first 6 months of Card Membership.

New Offer: You might possibly qualify for a huge 100,000 or 125,000-point Platinum welcome bonus with the Platinum Card® from American Express. See if you qualify for the Amex Platinum 100,000 or 125,000 offer (no hard credit pull): CardMatch™

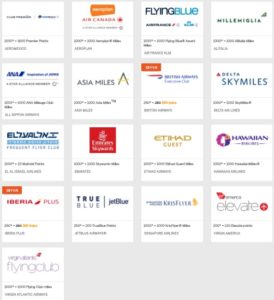

American Express Transfer Partners

You have a wide variety of 1:1 airline transfer partners including:

- Aer Lingus

- AeroMexico

- Air Canada

- Alitalia

- ANA

- Avianca

- British Airways

- Cathay Pacific

- Delta

- El Al

- Emirates

- Etihad

- Air France KLM

- Iberia

- Hawaiian Airlines

- JetBlue

- Qantas

- Singapore Airlines

- Virgin Atlantic

Hotel transfer partners include:

- Choice Hotels

- Hilton

- Marriott Bonvoy

The Platinum Card from American Express also comes with a few other premium travel perks like up to $200 air travel credit for incidental fees at one qualifying airline (in the form of a statement credit; enrollment required) and a fee credit for Global Entry or TSA PreCheck. In addition to enjoying TSA PreCheck or Global Entry access, cardholders can also enjoy CLEAR perks. Cardholders can use their Card and get up to $189 back per year on their CLEAR® membership. Terms apply.

Cardholders earn 5x Membership Rewards® Points for flights booked directly with airlines or with American Express Travel, up to $500,000 on these purchases per calendar year, and earn 5x Membership Rewards® points on prepaid hotels booked with American Express Travel.

Cardholders can get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when they pay with the Platinum Card®. The Hotel Collection requires a minimum two-night stay.

Also, select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Card.

Plus, American Express has expanded The Centurion® Network to include 40+ Centurion Lounge and Studio locations worldwide. Now there are even more places your Platinum Card® can get you complimentary entry and exclusive perks.

Other Platinum Card from American Express Benefits

There’s also a digital entertainment credit, making this card one of the best for streaming services. Cardholders can get up to $20 in statement credits each month when they pay for eligible purchases with the Platinum Card®. Enrollment required.

In addition to enjoying TSA PreCheck or Global Entry access, cardholders can also enjoy CLEAR perks. Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card®.

Another exciting benefit is the ability for cardholders to get up to $300 back each year in the form of statement credits on an Equinox+ subscription or any Equinox club membership when they pay with their Platinum Card. Enrollment required.

Plus, get a $155 Walmart+ credit, which covers the cost of a $12.95 monthly Walmart+ membership with a statement credit after you pay for Walmart+ each month with your Platinum Card. The cost includes $12.95 plus applicable local sales tax.

Get the full details and learn more in our in-depth The Platinum Card from American Express review.

The annual fee is $695 (See Rates & Fees) but can be offset with the perks, which are valued at over $1,400.

The Citi Premier Card: 60,000 Points Signup Bonus Offer; Airline Transfer Partners

The information for the Citi Premier® Card has been collected independently by Johnny Jet. The card details on this page have not been reviewed or provided by the card issuer.

The Citi Premier® Card is sometimes overlooked, and it shouldn’t be. For one, it earns up to 3x rewards on categories that include travel and things like gas and groceries. It also comes with a $100 annual statement credit for your hotel stay. You can also redeem your rewards for travel.

Cardholders earn:

- 3x points on

- Restaurants

- Supermarkets

- Gas stations

- Air travel and hotels

- 1x point on all other purchases

1:1 Point Transfers

You can also transfer points at a 1:1 ratio in 1,000-point increments to several international airline partners. This may get you more mileage from each ThankYou point.

The Citi transfer partners include:

- Aeromexico

- Air France/KLM

- Avianca

- Cathay Pacific

- Emirates Skywards

- Etihad Airways

- EVA Air

- JetBlue

- JetPrivilege

- Malaysia Airlines

- Qantas

- Qatar Airways

- Singapore Airlines

- Thai Airways

- Virgin Atlantic

There are also two hotel transfer partners, Choice Privileges (2:1 transfer ratio) and Wyndham Rewards (1:1 transfer ratio).

These transfer partners are best for booking international flights as Jetblue is the only domestic transfer partner.

However, you may also be able to book partner flights on domestic carriers. For example, you can transfer your points to Avianca to book an award flight on United Airlines.

Citi Premier Signup Bonus

New Citi Premier® Card cardmembers can earn 60,000 bonus ThankYou® Points after spending $4,000 in purchases within the first 3 months of account opening. This bonus is redeemable for $600 in gift cards or travel rewards when redeemed at thankyou.com. Plus, for a limited time, earn a total of 10 ThankYou® Points per $1 spent on hotel, car rentals, and attractions (excluding air travel) booked on the Citi Travel℠ portal through June 30, 2024.

While redeeming your bonus for gift cards doesn’t automatically sound very exciting, note that those gift card options include Airbnb, several cruise lines, plus numerous stores and restaurants.

Before you try, however, it’s important to verify that you qualify for this bonus if you currently have other Citi credit cards that earn ThankYou points.

With the free CardMatch™ tool, you can see what credit cards you have the best approval chances of, including with the Citi Premier Card. You may also get the chance to earn a higher credit card offer welcome/signup bonus than what is being offered to the general public.

Which Credit Card is Best for Flying Miles??

Here are our picks for the best flying miles credit cards in 2024. Use the table below to learn more about these cards and their bonuses:

- Best overall see more info here: Chase Sapphire Preferred® Card

- 60k Points Offer: American Express® Gold Card

- Best Miles Credit Card 75k bonus: Capital One Venture Rewards Credit Card

- Best Airlines Miles Credit Card Premium: The Platinum Card® from American Express

- Airline Credit Card for Incidental Fees: Chase Sapphire Reserve®

- Business Credit Card: Ink Business Preferred® Credit Card

- Best Air Miles Credit Card: Avianca Lifemiles credit cards

My favorite current offer: is the Chase Sapphire Preferred® Card

Best Credit Cards for Airline Miles

Below is my expert list of the best credit cards for airline miles for all the airline alliances, and all the miles you can earn with each airline.

Best Credit Card for Airline Miles in the Star Alliance

The information for the Avianca Vida Visa® Card and the Avianca Vuela Visa® Card has been collected independently by Johnny Jet. The card details on this page have not been reviewed or provided by the card issuer.

The Avianca Lifemiles credit cards offer a simple signup bonus that is easy to earn. Below are the current welcome bonus offers for both airline miles credit cards:

Avianca Vida Visa® Card: 20,000 welcome bonus miles after first purchase.

Avianca Vuela Visa® Card: 40,000 welcome bonus miles after the first purchase.

This is the best credit card for airline miles from a Star Alliance airline.

Chase Ink Business Preferred Credit Card – Best Business Credit Card for Travel Miles

The Ink Business Preferred® Credit Card holds the honor of having the most valuable Ultimate Rewards signup bonus and being one of the best business credit cards for travel.

New Ink Business Preferred® Credit Card cardholders can earn 100k bonus points after spending $8,000 on purchases in the first 3 months from account opening. That’s $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠.

Additionally, you also have full access to the Chase 1:1 airline and hotel transfer partners. This helps make it the best miles credit card for businesses since you can transfer out points.

You earn 3x points on the first $150,000 in combined spending for travel purchases and select business purchases like online advertising, telecommunications, and office supply stores.

This Ink Business Preferred review offers further insight into how good this business card can be. The annual fee is $95.

British Airways Visa Signature Card

The British Airways Visa Signature® Card is known for its massive limited-time bonus offers.

New British Airways Visa Signature® Card cardholders can earn 75,000 Avios after spending $5,000 on purchases within the first three months of account opening.

Cardholders earn 3 Avios per $1 spent on purchases with British Airways, Aer Lingus, Iberia, and LEVEL. Cardholders also earn 2 Avios per $1 spent on hotel accommodations when purchased directly with the hotel. Plus, earn 1 Avios per $1 spent on all other purchases.

Use your points to book a flight like the U.S. West Coast to Hawaii for 12,500 Avios each way on Alaska or American Airlines. Or, you can book short-haul flights within the U.S., Europe, or Asia starting at 4,500 each way.

Spending $30,000 in a year also lets you get the Travel Together ticket. With this perk, your travel companion gets a free seat in the same cabin when you pay with points. You will still have to pay fees and taxes on this complimentary seat. This is easily one of the best air miles credit cards.

Learn more in our British Airways Visa Signature Card review. Aer Lingus and Iberia also have perks and bonuses on their Avios earning cards.

Are Credit Cards That Give You Miles Worth It?

Yes, miles credit cards are worth it when the bonus, perks, and benefits offset the annual fee. In many cases, the best credit cards for airline miles have bonuses over $500 and come with a free checked bag, travel credits, category spending bonuses, and TSA Precheck credit.

Which Credit Card is Best for Mileage?

The miles cards listed below are the best cards for mileage since they have bonuses of up to 100,000 miles. They can help you on your way to achieving 100,000 miles which are easily worth $1,200 in most cases.

- The Best Overall: Chase Sapphire Preferred® Card

- Best Miles Credit Card: Capital One Venture Rewards Credit Card

- Best Airlines Miles Credit Card Premium: The Platinum Card® from American Express

- Airline Credit Card for Incidental Fees: Chase Sapphire Reserve®

- Business Credit Card: Ink Business Preferred® Credit Card

- Best Air Miles Credit Card: Avianca Lifemiles credit cards

What are the Best Miles Credit Cards for Free Flights?

The average number of airline miles you need for a free flight depends on the airline you choose to fly with, your destination, and when you decide to travel. Keep in mind there are no completely free flights, even if you use your points. You’ll still have to shell out the cost of taxes and any applicable fees imposed by the carrier. The best airline miles credit cards help you book free flights faster.

Here’s what you need regarding points for free flights, based on some of the biggest U.S.-based airlines.

Best Airline Credit Cards for Flights with American Airlines

American has AAnytime awards for seats on an American Airlines or American Eagle flight. Flights can cost around 20,000 miles each way, plus any applicable taxes and carrier-imposed fees.

They also have MileSAAver awards that are available for 7,500 miles each way (plus taxes and fees). There aren’t any blackout dates, so the availability of these types of fares may be more difficult to book. These are some of the best credit cards for American Airlines flyers and the best business credit cards to use for American Airlines.

Best Air Miles Credit Card for Free Flights with United Airlines

Similar to American Airlines, United has its Saver Award, which can be used for flying anywhere on United, United Express, and MileagePlus airline partners. One-way domestic flights cost anywhere from 10,000 to 50,000 points.

Saver Awards may require fewer points than their Everyday Awards. But again, it might be harder to find flights due to high demand. There are typically more seats available using Everyday Awards.

You can see the best United Airlines credit cards in this expert review.

Best Credit Cards for Miles with Southwest Airlines

Reward pricing on Southwest Airlines depends on destination, time, date of travel, and other factors. One of the easiest ways to earn rewards with Southwest is to take advantage of the bonus offers that come with their credit cards.

Here are the best Southwest credit cards as well as the best Southwest business credit cards.

The easiest way to see how much fares cost is to go to their site and put in your flight information. At the top of the page, you can choose the “points” view.

Best Airline Miles Credit Card for JetBlue Flights

JetBlue has a deals section — and one-way flights start at 7,600 points, plus taxes and fees. For domestic award flights, taxes/fees are $5.60 for one-way and $11.20 for round-trip flights. For international award flights, taxes/fees range from $5.60-$161.50 for one-way and $27.60-$171.60 for round-trip flights.

To find out exactly how many points you need for a particular flight, you need to visit JetBlue’s website and filter with the “points view.”

Air Miles for Award Flights with Alaska Airlines

Flights that can be redeemed with points range from 5,000 miles to 70,000, depending on how far you fly and what class ticket you book.

Alaska Airlines offers Money & Miles awards, in which you can get up to 50 percent off on most coach and first-class tickets. The maximum discount is $100 off of a base fare ticket for 10,000 miles or $200 off the base fare for 20,000 miles. They can still earn all of the miles flown when you choose this award.

Airline Miles for Reward Flights with Air Canada

Air Canada uses its Aeroplan program, and flights redeemed with points start at 15,000 points and go all the way to 260,000. Air Canada takes advantage of its robust airline partnerships, which means you can easily fly to over 1,300 destinations worldwide using the Star Alliance member airlines.

See their helpful chart of how many points you need to redeem a free flight.

You may also take advantage of the Aeroplan® Credit Card, a co-brand Air Canada card with Chase. This card earns 3x points on:

- Grocery store purchases

- Dining at restaurants

- On purchases made directly with Air Canada

All other purchases earn 1x point per $1 spent.

Additionally, cardholders can earn an additional 500 bonus points for every $2,000 spent in a calendar month (up to 1,500 points per month).

Along with a free first checked bag, this card also comes with a 24/7 concierge. Additionally, cardholders can get a fee credit for Global Entry or TSA PreCheck®, or NEXUS.

New Aeroplan® Credit Card cardholders can earn 60,000 bonus points after spending $3,000 on purchases in the first 3 months of account opening.

The annual fee is $95, and there are no foreign transaction fees.

Related: Aeroplan Credit Card Review

What Is The Best Card to Collect Miles?

The best way to earn points is to sign up for the best travel credit card to collect miles or an airline-branded credit card. They offer simple ways to earn extra points.

The best travel miles credit cards for premium travelers include the Chase Sapphire Reserve, the Platinum Card from American Express, and more.

The best cards to collect miles and use is the one that fits your specific travel needs the best.

What Credit Card Miles Are Worth the Most?

In my opinion, the Chase Ultimate Rewards points are worth the most. Here are all the top credit card miles that are worth the most, and the best cards to earn those miles:

- The Best Overall: Chase Sapphire Preferred® Card

- Best Miles Credit Card: Capital One Venture Rewards Credit Card

- Best Airlines Miles Credit Card Premium: The Platinum Card® from American Express

- Airline Credit Card for Incidental Fees: Chase Sapphire Reserve®

- Business Credit Card: Ink Business Preferred® Credit Card

- Best Air Miles Credit Card: Avianca Lifemiles credit cards

Which Airline Credit Card Is Most Worth It?

If the premium cards are not worth it for you, consider these airline cards instead which have more reasonable annual fees. These are some of the best airline credit cards for the largest airlines.

Delta SkyMiles Gold American Express Card

The Delta SkyMiles® Gold American Express Card is the most flexible of the four personal Delta credit cards for casual and regular flyers.

There’s also a 20% in-flight purchase credit and the first checked bag is free for you and up to 8 companions.

You get priority boarding on Delta flights plus Main Cabin 1 Priority Boarding.

The Delta SkyMiles Gold Credit Card earns 2x Miles on Delta purchases at restaurants worldwide (including takeout and delivery in the U.S.) and at U.S. supermarkets (1x Mile for everything else that is eligible). It also has 20% savings in the form of a statement credit after you use your Card on eligible Delta in-flight purchases of food, beverages, and audio headsets.

Take up to $50 off the cost of your flight for every 5,000 miles you redeem with Pay with Miles when you book on delta.com.

Plus, Gold card members will receive a $100 Delta Flight Credit after spending $10,000 in purchases on their card in a calendar year. Cardholders can use the Credit for future travel.

Cardholders can also get 15% off when using miles to book Award Travel on Delta flights through delta.com and the Fly Delta app. Discount not applicable to partner-operated flights or to taxes and fees.

With Send & Split®, you can send money and split your Card purchases with any other Venmo or PayPal user, directly from the Amex App. Enroll today.

Welcome Bonus

New Delta SkyMiles® Gold American Express Card cardholders can earn 40,000 bonus miles after they spend $2,000 in purchases on their new Card in their first 6 months.

The introductory annual fee of $0 for the first year, then $99 (See Rates & Fees).

United Explorer Card

The United℠ Explorer Card gives you priority boarding for everyone in your party and waives the first checked bag fee for you and one companion. You also get 25% back on United® inflight purchases, and two one-time United Club passes each year.

United also reimburses your Global Entry or TSA PreCheck fee and can get complimentary Premier Upgrades (when available). The $95 annual fee is waived for the first year.

This is one of the few airline cards to award bonus miles on non-airline purchases. You get 2x miles on dining and eligible delivery services, hotels, plus United® purchases. All non-bonus spending earns 1 mile per $1.

It is one of the best United credit card options.

New United℠ Explorer Card cardholders can earn 60,000 bonus miles after spending $3,000 on purchases in the first 3 months of account opening.

Plus, there’s a $0 introductory annual fee for the first year, then $95.

Citi / AAdvantage Platinum Select World Elite Mastercard

The information for the Citi® / AAdvantage® Platinum Select® World Elite Mastercard® has been collected independently by Johnny Jet. The card details on this page have not been reviewed or provided by the card issuer.

The Citi® / AAdvantage® Platinum Select® World Elite Mastercard® lets you and four travel companions on the same itinerary check the first bag free. You also get priority boarding, 25% in-flight savings, and a $125 flight discount when making $20,000 in annual card purchases and renewing your card.

In addition to earning 2x miles on American Airlines purchases, you also earn double points at restaurants and gas stations.

The $99 annual fee is waived for the first year. New cardholders can earn 50,000 bonus miles by spending $2,500 in the first 3 months.

It is one of the many and best Citi credit card options that may work for you.

Southwest Rapid Rewards Priority Card – Best Airline Miles Credit Card

Two annual benefits the Southwest Rapid Rewards® Priority Credit Card gives you are a $75 Southwest travel credit and four Upgraded Bookings.

Cardholders earn unlimited:

- 3x points on Southwest® purchases

- 2x points on local transit and commuting, including rideshare

- 2x points on internet, cable, phone services, and select streaming purchases

New Southwest Rapid Rewards® Priority Credit Card cardholders can earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

For each card anniversary, you also earn 7,500 bonus points.

One of the best Southwest credit card options, this card can get you even closer to a coveted Southwest Companion Pass®. Also, remember that Southwest offers all passengers to enjoy the first two checked bags for free.

When to Transfer Credit Card Points to Your Favorite Loyalty Program

Why Transfer Credit Card Points?

With airline miles credit cards like the Capital One Venture and Chase Sapphire Preferred, it’s easy to redeem accumulated miles for travel. Each card has a system for essentially erasing travel-related purchases from your monthly statement. So why would you want to transfer credit card points to your airline miles account?

The short answer is that doing so can often make your points go further. This is because it requires fewer points to book a flight. Obviously, if you would rather erase tour packages or Airbnb bookings, points, and miles aren’t going to be very helpful on a frequent flyer account. Whether to transfer or not depends on what you want to do with the points you have.

When Should I Transfer Travel Points to Airline Miles?

You should opt to transfer credit card points to a participating air miles partner when the flight you want to book costs fewer miles when paid for with frequent flyer points than credit card points. Or when the credit card company offers additional miles when you transfer, as exemplified in this Chase Sapphire Preferred review.

Often, credit card points or miles are worth 1 cent apiece. However, when transferred they sometimes get a boost if airlines value miles at something closer to 1.5 or 2 cents per mile. The deciding factor should be how many miles the flight costs with each method. If a domestic round-trip flight requires 25,000 Delta SkyMiles but would only cost $150 (or 15,000 credit card points), you would be wasting miles if you transfer them first. On the flip side, if that same flight costs a whopping $395 (or 39,500 credit card points), you’d be silly not to transfer and book through the airline.

It is important to keep in mind, however, that each of the best credit cards for travel miles offers bonuses to make sure you’re not cheating yourself out of earning additional points or miles.

The Best Credit Card for Travel Rewards Programs Examples

Chase Ultimate Rewards

The Chase Sapphire Preferred is often touted as the best credit card for travel on the market. One reason is that Chase allows you to transfer Ultimate Rewards points to participating in frequent flyer programs. Those programs include Aer Lingus AerClub, Air Canada Aeroplan, British Airways Executive Club, Emirates, Flying Blue AIR FRANCE KLM, Iberia Plus, Korean Air SKYPASS, Singapore Airlines KrisFlyer, Southwest Airlines Rapid Rewards, United MileagePlus, and Virgin Atlantic Flying Club. You can also transfer to hotel partners, including IHG Rewards Club, Marriott Bonvoy, and World of Hyatt.

Points transferred are on a 1:1 ratio. This means that however many credit card points you have, that’s how many frequent flyer miles you’ll get. Keep in mind that when booking through the Chase Ultimate Rewards portal, you’ll earn 25% more points than booking elsewhere with the Sapphire Preferred. That means in order to make a transfer of miles to an airline program worth it, the flight would have to cost at least 25% more through Chase Ultimate Rewards.

Keep in mind that once you transfer the points you can’t reverse the action to get them back into your Chase account. So make sure of your decision before you click!

How to Transfer Ultimate Rewards

To redeem points or transfer them, start on your Ultimate Rewards Dashboard. Book travel through Chase Ultimate Rewards by selecting “Redeem for travel,” and you will be taken to a booking portal. But to transfer to Chase’s travel partners, select “Transfer your points” and choose from their list of airline and hotel partners. You’ll type in your frequent traveler account info and select how many points you want to transfer. It’s that easy.

American Express Membership Rewards Program

American Express credit cards have a larger pool of airline partnerships to choose from. There are more than 20 airline partners and three hotels to choose from. However, check carefully before transferring. While most programs offer a 1:1 rate, one or two, like JetBlue, offer fewer miles per credit card point. On the flip side, others, like Aeromexico, offer quite a few more, which makes transferring even more attractive.

It’s often worth it to transfer points because Membership Rewards purchases only offer a value of 1 center per point maximum even less if you’re redeeming for any travel-related purchases other than airlines (like hotels or cruises).

How to Transfer Amex Points

To transfer American Express points, log in to your American Express account and go to the Transfer Points page. You’ll have to connect your existing frequent customer program account to your American Express account, just like with Chase. Choose the preferred frequent customer program to which you’d like to transfer points. Then, follow the step-by-step instructions to finish your transfer.

Transfers are usually immediate, though a few airlines can take up to a week to update your points total. The cost to transfer is negligible, but American Express does charge .06 cents per point for transfers (or 60 cents per 1,000 points).

Amex also doesn’t offer an even redemption value across the board. Nor do they offer one simple way to redeem points for travel purchases. Depending on the airline and whether you’re spending on hotels, taxis, or other travel-related purchases, points can be worth as little as 5 cents per dollar. Make sure to do your homework before redeeming those miles. But, thankfully it’s almost always worth it to transfer to airline partners if redeeming with AmEx.

When You Should Transfer Credit Card Points to Airline Miles Credit Cards

The long and short of it: Before booking a flight through traditional channels and redeeming miles through statement credits, check to see how many airline miles would be required to purchase the flight in question through your Frequent Flyer account. You may be surprised at how many points you can save.

You should always try to redeem your travel miles when each point is worth at least one cent each. Getting a travel redemption bonus or having the ability to transfer travel miles directly to a loyalty program is a common trait of the best credit cards for travel miles.

Premium Co-Branded Airline Credit Cards for Miles

If you fly often, the three legacy carriers (American, Delta, and United) all offer a premium credit card. This premium airline credit card is the best option if you want lounge access, companion certificates, and a fast track to achieving elite status.

United Club Infinite Card

One of the main reasons to get the United Club℠ Infinite Card is for the complimentary United Club membership, a $650 value per year. Plus, get a fee credit of up to $100 for Global Entry, TSA PreCheck®, or NEXUS.

Cardholders earn 4x miles per $1 spent on United® purchases, 2x miles per $1 spent on all other travel, 2x miles per $1 spent on dining, and 1x miles per $1 spent on all other purchases.

Cardholders can also get 25% back as a statement credit on purchases of food, beverages, and Wi-Fi onboard United-operated flights when paying with their Club Infinite Card.

Additionally, earn up to 10,000 Premier qualifying points (25 PQP for every $500 you spend on purchases).

You also get free first and second-checked bags, savings of up to $320 per roundtrip (terms apply), plus Premier Access® travel services. Also, get a 10% United Economy Saver Award discount within the continental U.S. and Canada.

New United Club℠ Infinite Card cardholders can earn 80,000 bonus miles after spending $5,000 on purchases in the first 3 months from account opening.

Though there is a $525 annual fee, this is one of the best United credit cards.

Citi / AAdvantage Executive World Elite Mastercard – American Airlines

The information for the Citi® / AAdvantage® Executive World Elite Mastercard® has been collected independently by Johnny Jet. The card details on this page have not been reviewed or provided by the card issuer.

The Citi® / AAdvantage® Executive World Elite Mastercard® gives you an automatic Admirals Club membership for a $650 annual savings. Up to two guests or your immediate family traveling with you can accompany you to the Admirals Club.

This card’s annual fee is $595 but no foreign transaction fees on purchases. But, it can be worth it if you visit Admirals Club lounges regularly and use the premium American Airlines perks often.

Additional card benefits include a free first checked bag for you and up to 8 companions traveling with you on the same reservation on domestic American Airlines itineraries. You’ll also get priority check-in, security screening, and boarding plus 25% savings on American Airlines in-flight purchases. A Global Entry or TSA PreCheck application fee credit is also included.

Earn a total of 4 AAdvantage® miles for every $1 spent on eligible American Airlines purchases.

New Citi® / AAdvantage® Executive World Elite Mastercard® cardholders can earn 70,000 American Airlines AAdvantage® bonus miles after spending $7,000 within the first 3 months of account opening. Plus, enjoy a complimentary Admirals Club® membership (a value of up to $850).

Delta SkyMiles Reserve American Express Card – Premium Delta SkyMiles Credit Card

The Delta SkyMiles® Reserve American Express Card gives you Main Cabin 1 priority boarding and the first checked bag free on Delta flights for you and up to 8 travel companions.

Enjoy Delta Sky Club® access at no cost and bring up to two guests or immediate family at a rate of $50 per person per visit. Effective 2/1/25, Reserve Card Members will receive 15 Visits per year to the Delta Sky Club; to earn an unlimited number of Visits each year starting on 2/1/25, the total eligible purchases on the Card must equal $75,000 or more between 1/1/24 and 12/31/24, and each calendar year thereafter.

Plus, enjoy complimentary access to The Centurion® Lounge or Escape Lounge – The Centurion® Studio Partner when you book your Delta flight with your Reserve Card.

One exciting reason to get this card is the annual Companion Certificate. Cardholders can receive a Domestic First Class, Delta Comfort+® or Main Cabin round-trip companion certificate each year upon renewal of their Card. Payment of the government-imposed taxes and fees of no more than $80 for roundtrip domestic flights (for itineraries with up to four flight segments) is required. Baggage charges and other restrictions apply. See terms and conditions for details.

Receive upgrade priority over other Medallion Members within the same Medallion level and fare class.

Additional Perks

There is also a fee credit for Global Entry or TSA PreCheck. Fee Credit for Global Entry or TSA PreCheck® after you apply through any Official Enrollment Provider. If approved for Global Entry, at no additional charge, you will receive access to TSA PreCheck.

Cardholders earn 3x miles on Delta purchases and 1x mile for all other eligible purchases.

Eligible Card Members get 15% off when using miles to book Award Travel on Delta flights through delta.com and the Fly Delta app. Discount not applicable to partner-operated flights or to taxes and fees.

This is one of the best Delta Airlines credit cards.

New Delta SkyMiles® Reserve American Express Card cardholders can earn 60,000 bonus miles after spending $5,000 in purchases on their new Card in their first 6 months.

With Status Boost®, earn 15,000 Medallion Qualification Miles (MQMs) after you spend $30,000 in purchases on your Card through 12/31/23, up to four times per year getting you closer to Medallion Status. MQMs are used to determine Medallion Status and are different from the miles you earn towards flights. Effective 1/1/24, this benefit will no longer be available, and there will be a new way to earn toward Medallion Status with the Card. Learn more at delta.com/skymilesprogramchanges.

The annual fee is $550, but there are no foreign transaction fees (See Rates & Fees).

FAQs

What Is The Point Of A Travel Credit Card?

There are many travel credit cards to choose from, but having an idea of which benefits you can use most often will streamline the comparison process. Perks come in different shapes and sizes including:

- Airport lounge access

- Checked bags

- Elite loyalty status

- Free Global Entry or TSA PreCheck

- Hotel anniversary nights

- Hotel experience credits

- In-flight purchase statement credits

- No foreign transaction fee

- Priority boarding on flights

- Rental car privileges

Premium credit cards tend to offer the most benefits but also charge a higher annual fee. However, you can quickly offset the membership cost when you use the benefits on a regular or semi-regular frequency. You can save hundreds or thousands versus buying each perk separately, depending on the card.

It can be easy to choose a travel credit card by listing your favorite benefits and estimating your travel budget.

How do credit card miles work?

You earn a set amount of miles per purchase according to the credit card rewards program. Each credit card has different redemption options. The most common travel redemption options are:

- Statement credits for recent travel purchases

- Booking future travel on the credit card travel portal

- Transferring points to linked airline and hotel loyalty programs

Credit card miles are usually worth 1 cent each when redeemed for statement credits or future travel bookings. Their value can vary when you transfer them because each loyalty program assigns a different value to the points. However, your points are usually worth at least one cent each when redeeming for flights directly from the airline.

How many Airline miles do you need to get a free flight?

The number of miles needed to book award flights depends on factors including the airline, seat location, travel distance, time of year, and current cash value ticket price. Most airlines use floating award prices meaning the price fluctuates. A few airlines still use a fixed price, so you pay the same amount.

Southwest Airlines is one of the lowest-cost carriers for domestic flights. A one-way flight can cost between 5,000 and 10,000 miles plus $5.60 in fees and taxes. A major airline like United or American can charge 12,500 miles for a one-way flight in the main cabin across the United States. A one-way first-class flight within the U.S. can cost 25,000 plus fees and taxes.

For international travel, you may go as little as 30,000 miles each way to visit Europe in the main cabin or as much as 155,000 miles for a premium cabin seat plus fees and taxes.

What is the best credit card for airline miles?

The Chase Sapphire Reserve is the best credit card for earning bonus miles with any airline. Your points are worth 50% more than cash reward when booking award travel on the Chase Ultimate Rewards travel center. You can also transfer them at a 1:1 ratio to airline partners including United Airlines, Southwest Airlines, British Airways, and Emirates.

If you regularly pay checked baggage fees and are loyal to a certain airline, getting a co-brand airline credit card is better. One of the best is the Delta SkyMiles® Gold American Express Card. The first checked bag is free for the primary cardholder and up to 8 companions on Delta flights.

Which credit card earns the most air miles?

The Platinum Card from American Express earns the most air miles for most plane ticket purchases. You earn 5 Membership Rewards per $1 on plane tickets purchased directly from the airline or on AmexTravel.com, up to $500,000 spent annually. Most cards only award up to 3 points per $1 on plane ticket purchases.

The Business Platinum Card® from American Express is the best small business card. It earns 5x Membership Rewards® points per $1 on flights and prepaid hotels booked on AmexTravel.com. Like personal credit cards, most business cards award up to 3x points per $1 on travel purchases.

Cardholders earn 1.5x points (that’s an extra half point per dollar) on eligible purchases at US construction material, hardware suppliers, electronic goods retailers, and software & cloud system providers, and shipping providers, as well as on purchases of $5,000 or more everywhere else, on up to $2 million of these purchases per calendar year.

Plus, get up to $200 in statement credits per calendar year for incidental fees charged by your one selected, qualifying airline to your Card.

Additionally, unlock over $1,000 in annual statement credits on the curation of business purchases, including select purchases made with Dell Technologies, Indeed, Adobe, and U.S. wireless service providers.

Cardholders can get up to $189 in statement credits per calendar year on your CLEAR® Plus Membership (subject to auto-renewal) when they use their Business Platinum Card®.

With complimentary access to more than 1,400 airport lounges across 140 countries and counting, with The American Express Global Lounge Collection®. Enrollment is required for some lounges.

The annual fee is $695 (See Rates & Fees).

Check out the best business miles credit cards for more business options.

What is the difference between an airline credit card and a travel credit card?

An airline credit card partners with a specific airline loyalty program. Branded airline credit cards only offer bonus travel rewards like free checked bags or inflight purchase credits for that specific airline. These cards also earn frequent flyer miles on every purchase. For instance, a United Airlines credit card earns MileagePlus miles on every card purchase.

Travel credit cards earn bonus credit card miles on almost every travel purchase, regardless of which airline or hotel it is. These credit cards also let you redeem your points for travel purchases on multiple carriers. Premium travel credit cards offer additional travel benefits like statement credits or airport lounge access that are not connected to a specific airline.

Do air miles expire?

Most air miles expire after 24 months of frequent flyer account inactivity. You must usually earn more miles within this period to renew your miles.

Delta SkyMiles and Southwest Airlines Rapid Rewards rewards don’t expire if your frequent flyer account remains in good standing. Other smaller or international-based airlines may have a no-expiration policy. Check your frequent flyer account terms to see their most current policy.

Do airline credit cards charge an annual fee?

A lot of branded airline credit cards charge an annual fee of at least $95 up to $695 each year. Some of these cards waive the annual fee for the first 12 months. The more expensive cards usually offer more add-on benefits like lounge passes or an annual one-time companion ticket.

A couple of airlines offer a card with no annual fee, but this card doesn’t include extra benefits like free checked bags or priority boarding. One example is the Delta SkyMiles® Blue American Express Card (See Rates & Fees). It earns 2x miles per dollar at restaurants worldwide, plus takeout and delivery in the U.S. Additionally, it earns 2x miles per dollar spent on Delta purchases and 1x mile on all other eligible purchases. Plus, you can Pay with Miles: take up to $50 off the cost of your flight for every 5,000 miles you redeem with Pay with Miles when you book on delta.com. Plus, receive a 20% savings in the form of a statement credit after using your Card on eligible Delta in-flight purchases of food and beverages.

What’s the Point of Airline Credit Cards?

Consider an airline credit card when you fly with a particular airline several times per year. You can enjoy special benefits like free checked bags, expedited boarding, and in-flight purchase discounts along with the ability to earn miles on every card purchase.

Most airlines offer several products with different benefits and annual fees to help frequent, regular, and occasional travelers find the best option for their travel habits.

Some of the best airline credit card programs include:

Related: 4 Reasons Why Airline Miles Are Not Worth It

Related Articles:

- Are Travel Credit Cards worth it?

- The Best Metal Credit Cards

- 7 Exotic Travel Destinations Made Easier With Airline Miles

For rates and fees of The American Express® Gold Card, please click here.

For rates and fees of the Delta SkyMiles® Gold American Express Card, please click here.

And for rates and fees of the Delta SkyMiles® Blue American Express Card, please click here.

For rates and fees of The Platinum Card® from American Express, please click here.

For rates and fees of the Delta SkyMiles® Reserve American Express Card, click here.

And for rates and fees of The Business Platinum Card® from American Express, please click here.

I have one American Express card. I think the card is good enough for shopping and travel purpose.

American Express Membership Rewards are definitely a good option for travel miles.

THANK YOU FOR SHARING THE INFORMATION AND GUIDE. its REALLY AWESOME ARTICLE.KEEP UP THE GOOD WORK

I have some questions on the Chase Sapphire reserve card.

On a joint account do you need to pay the extra $75 for your spouses card? Or is that just pertain to my son or daughter?

Can you cancel the card after one year without a penalty?

How do the benefits for upgrades, pre-boarding, parks pan out?

Does Chase have a customer service telephone number I can call with questions before I apply for the card?

Thank you.

It is very informative post. No doubt very efficiently explained so one can easily submit site to directly submission list. Thanks

The Hilton Group’s largest ever expansion suggests that we will keep travelling for both business and leisure in the foreseeable future.

Thanks for that post it has plenty of information to consider. My American Express sure does not give me many benefits as I thought!

I get offered from american express credit card. After reading this article hope I can have one. Thanks for sharing.

Who s this for? Delta frequent fliers who don t mind paying for perks should consider the Platinum Delta SkyMiles® Credit Card. While its $195 annual fee is a tad steeper than most mid-tier airline cards, the card benefits make up the difference. You just have to be prepared to navigate the somewhat complicated world of Delta s frequent flier rewards program.

Yup, I agree. I wish Delta would publish an award chart. I prefer to earn points that can be transferred out to multiple airlines, so you have flexibility. But the Delta cards make sense for Delta loyalists.

Thanks for that post it has plenty of information to consider. My American Express sure does not give me many benefits as I thought

Read more at: https://johnnyjet.com/best-credit-cards-for-travel-miles/

Thanks a lot for this amazing article. I have read the post and it’s very useful to me. Some awesome stuff and I highly recommend ALL of it…

It was hard for me to believe at first I could even read a book of this length. Your style caught my interest. Your content was outstanding. Great Article Neil. It was fantastic! I’ve just went through it, but didn’t leave any comments. However, I thought that the article was informative enough to warrant a thanks. I’ll be implementing some of these suggestions soon on my sites.