This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page.

Are you using the best Delta Air Lines credit cards in 2023 for your Delta Air Lines purchases? By using the following Delta cards, you can earn the most rewards possible and additional travel perks like free checked bags, Delta SkyClub access, AND even a Companion Certificate. Depending on what Delta rewards you want to earn, there are several options to choose from. Also, note that beginning January 01, 2023, Delta SkyClub access changed.

Plus, right now, several of the Delta cards have nice welcome bonuses, perfect to help give you a boost on future travel. In addition to these everyday purchase rewards that can be redeemed for Delta award flights, you will also enjoy additional benefits with each of these best Delta credit cards for 2023.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Best Delta Credit Cards 2023

These are the current Delta Air Lines credit cards available for both consumers and business owners along with their welcome bonus offers.

Personal Delta SkyMiles Credit Cards

- New Delta SkyMiles® Blue American Express Card cardholders can earn 10,000 bonus miles after spending $1,000 in purchases on their new Card in their first 6 months.

- New Delta SkyMiles® Gold American Express Card cardholders can earn 40,000 bonus miles after they spend $2,000 in purchases on their new Card in their first 6 months.

- And New Delta SkyMiles® Platinum American Express Card cardholders can earn 50,000 bonus miles after spending $3,000 in purchases on their new Card in their first 6 months.

- New Delta SkyMiles® Reserve American Express Card cardholders can earn 60,000 bonus miles after spending $5,000 in purchases on their new Card in their first 6 months.

Business Delta SkyMiles Credit Cards

- New Delta SkyMiles® Gold Business American Express Card cardholders can earn 50,000 Bonus Miles after spending $2,000 in purchases on their new Card in their first 3 months of Card Membership.

- New Delta SkyMiles® Platinum Business American Express Card cardholders can earn 60,000 Bonus Miles after spending $3,000 in purchases on their new Card in their first 3 months of Card Membership.

- And new Delta SkyMiles® Reserve Business American Express Card cardholders can earn 70,000 Bonus Miles after spending $5,000 in purchases on their new Card in their first 3 months of Card Membership.

Which Delta Credit Card is Best?

Let’s get into what the best Delta credit cards offer. You’ll notice there are cards for different lifestyles and different travel goals. We’ll start with the ones that get worthwhile perks for the common travelers.

Delta SkyMiles Gold American Express Card

The Delta SkyMiles® Gold American Express Card comes with a built-in free checked bag benefit on Delta flights. And you can use your free checked bag perk for up to 8 people if they are traveling on the same itinerary. So a family of four can potentially save $240 per roundtrip on Delta flights! Plus, you’ll get Main 1 Priority Boarding.

Plus, Gold card members will receive a $100 Delta Flight Credit after spending $10,000 in purchases on their card in a calendar year. Cardholders can use the Credit to use toward future travel.

You get priority boarding on Delta flights plus Main Cabin 1 Priority Boarding.

The Delta SkyMiles Gold Credit Card earns 2x Miles on Delta purchases at restaurants worldwide (including takeout and delivery in the U.S.) and at U.S. supermarkets (1x Mile for everything else that is eligible). It also has 20% savings in the form of a statement credit after you use your Card on eligible Delta in-flight purchases of food, beverages, and audio headsets.

Additional Perks

You’ll get 20% savings in the form of a statement credit on eligible Delta in-flight purchases made on your card.

The Delta SkyMiles Gold American Express card also has very good perks when you fly on Delta metal. For starters, with Priority Boarding, you can get that coveted overhead bin space and into your seat before the rest of the passengers.

Additionally, you can Pay with Miles: take up to $50 off the cost of your flight for every 5,000 miles you redeem with Pay with Miles when you book on delta.com.

Cardholders can also get 15% off when using miles to book Award Travel on Delta flights through delta.com and the Fly Delta app. Discount not applicable to partner-operated flights or to taxes and fees.

Welcome Bonus

New Delta SkyMiles® Gold American Express Card cardholders can earn 40,000 bonus miles after they spend $2,000 in purchases on their new Card in their first 6 months.

The introductory annual fee of $0 for the first year, then $99 (See Rates & Fees).

Delta SkyMiles Blue American Express Card

The Delta SkyMiles® Blue American Express Card is a no annual fee and no foreign transaction fee Delta card (See Rates & Fees), so it’s a great option for budget-conscious travelers and frequent flyers who want a secondary rewards card. To maximize the benefits, cardholders should also fly Delta at least once a year.

It earns 2x miles per dollar at restaurants worldwide, plus takeout and delivery in the U.S. Additionally, earn 2x miles per dollar spent on Delta purchases and 1x mile on all other eligible purchases. Plus, you can Pay with Miles: take up to $50 off the cost of your flight for every 5,000 miles you redeem with Pay with Miles when you book on delta.com.

Cardholders also earn 20% savings in the form of a statement credit on eligible Delta in-flight purchases of food and beverages.

Welcome Bonus

New Delta SkyMiles® Blue American Express Card cardholders can earn 10,000 bonus miles after spending $1,000 in purchases on their new Card in their first 6 months.

But because the Delta SkyMiles® Blue American Express Card is a fee-free card (See Rates & Fees), you won’t enjoy any of the additional card benefits that come from the other co-brand Delta credit cards.

Chase Sapphire Preferred Card – For Delta Air Lines Partner

Casual Delta customers might find more value in a flexible travel rewards card like the Chase Sapphire Preferred® Card.

Enjoy Chase Sapphire benefits such as a $50 annual Ultimate Rewards Hotel Credit, 5x points on travel purchased through Chase Ultimate Rewards®, 3x points on dining, and 2x points on all other travel purchases, plus more.

You can redeem your rewards points for 1.25 cents each through the Chase Ultimate Rewards travel portal; most travel credit cards have a maximum redemption value of 1 cent each for award flights.

Your points are automatically worth 25% more because of the travel redemption bonus. What makes the Sapphire Preferred even more valuable is the ability to transfer your Ultimate Rewards points directly to a frequent flyer program on a 1:1 basis. While Delta isn’t a Chase travel partner, you can transfer your point to Air France Flying Blue or Korean Air to book a partner flight on Delta.

Signup Bonus

New Chase Sapphire Preferred® Card cardholders can earn 60,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening. That’s $750 when redeemed through Chase Ultimate Rewards®. Member FDIC

The annual fee is $95, and there are no foreign transaction fees.

Chase Sapphire Reserve

The Chase Sapphire Reserve® is the premium version of the Sapphire Preferred. You will earn 3x points on dining purchases, you can transfer your points to a Chase travel partner, or you can redeem them through the Chase travel portal for 1.5 cents each (even Delta flights!). As a premium travel card, you will also enjoy the following benefits:

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year

- Complimentary Priority Pass Select lounge access

- Global Entry/TSA Precheck application fee reimbursement

Plus, earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Ultimate Rewards® immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

The $300 annual travel credit can be used for airfare, checked baggage fees, and in-flight purchases. Basically, if the expenses can earn 3x bonus points, it’s eligible for the credit.

Signup Bonus

New Chase Sapphire Reserve® cardholders can earn 60,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when redeemed through Chase Ultimate Rewards®.

The annual fee is $550 but can be offset by the numerous travel perks. There are no foreign transaction fees.

The Platinum Card from American Express – Transfer to Delta

Because of the Amex-Delta relationship, The Platinum Card® from American Express also has several Delta-friendly travel benefits including 1:1 point transfers and complimentary Delta SkyClub access. For starters, you will earn 5x Amex Membership Rewards on all airfare booked directly through the carrier or AmexTravel.com, up to $500,000 on these purchases per calendar year. You can then transfer your points on a 1:1 basis directly to Delta and the other Amex air travel partners.

Prepaid hotels booked with American Express Travel earn unlimited 5x points.

Unless you want free checked bags or the annual Delta companion ticket, the Platinum Card from American Express can easily be the best non-Delta credit card when your primary focus is earning points instead of travel benefits. Besides the 5x point bonus and the direct 1:1 Delta points transfer option, you will enjoy the following travel benefits:

- Up to $200 in annual air travel statement credits for incidental fees at one qualifying airline (in the form of a statement credit; enrollment required)

- Global Entry or TSA PreCheck Application Fee Reimbursement

Plus, American Express has expanded The Centurion® Network to include 40+ Centurion Lounge and Studio locations worldwide. Now there are even more places your Platinum Card® can get you complimentary entry and exclusive perks.

Additionally, cardholders can get up to $100 in statement credits annually for purchases at Saks Fifth Avenue on their Platinum Card®, which is equal to $50 in statement credits semi-annually. However, you must be enrolled for this benefit.

Welcome Bonus Offer

New The Platinum Card® from American Express cardmembers can earn 80,000 Membership Rewards® points after spending $8,000 on purchases on their new Card in the first 6 months of Card Membership.

The annual fee is $695 (See Rates & Fees) but can be offset with the perks, which are valued at over $1,400.

Delta Business Credit Cards 2023

Here are the Delta business credit cards to put on your radar, especially if you need to travel for business. You can earn miles for your business, take advantage of airport perks, and enjoy Delta’s services.

Delta SkyMiles Gold Business American Express Card

With the Delta SkyMiles® Gold Business American Express Card, cardholders can check or stow their bag with ease by getting their First Checked Bag Free on Delta Flights + Main Cabin 1 Priority Boarding.

New Delta SkyMiles® Gold Business American Express Card cardholders can earn 50,000 Bonus Miles after spending $2,000 in purchases on their new Card in their first 3 months of Card Membership.

Card Members save 15% when booking Award Travel with miles on Delta flights when using delta.com and the Fly Delta app. Discount not applicable to partner-operated flights or to taxes and fees.

Additionally, take $100 off your next Delta flight – after you spend $10,000 in purchases on your card in a calendar year, you will earn a $100 Delta Flight Credit to use toward future travel.

Earn 2 Miles on every dollar spent on eligible purchases at U.S. shipping providers and eligible U.S. advertising purchases in select media. Effective 1/1/2024, this benefit will have a cap of $50,000 in eligible purchases per category per year.

Earn 2 Miles on every dollar spent on eligible purchases made directly with Delta and on every eligible dollar spent at restaurants and earn 1 Mile on every eligible dollar spent on other purchases.

There is a $0 introductory annual fee for the first year, then $99 (See Rates & Fees).

Delta SkyMiles Platinum Business American Express Card

The Delta SkyMiles® Platinum Business American Express Card is a great option for frequent flyers.

With Status Boost®, earn 10,000 Medallion® Qualification Miles (MQMs) after you spend $25,000 in purchases on your Card in a calendar year, up to 2x per year getting you closer to Medallion Status. MQMs are used to determine Medallion Status and are different from the miles you earn towards flights. Effective 1/1/24, this benefit will no longer be available, and there will be a new way to earn toward Medallion Status with the Card. Learn more at delta.com/skymilesprogramchanges.

You also earn 3x miles per $1 spent on purchases made directly with Delta and on eligible hotel purchases. Plus, you will earn 1.5 miles per dollar on single eligible purchases of $5,000 or more (that’s an extra half mile per dollar), up to 50,000 additional miles per year. You’ll earn 1 mile on every eligible dollar spent on other purchases.

If your purchase qualifies for a category that has a higher mileage accelerator, only the higher accelerator will apply (ex. you would earn 3X miles on purchases made directly with Delta and hotels instead of 1.5X).

Get access to Delta Sky Club® at a rate of $50 per person per visit for you and up to two guests or immediate family while flying together on Delta. Effective 1/1/24, this benefit will no longer be available.

Another perk of this card is the annual Domestic Main Cabin round-trip companion certificate each year upon renewal of your Card. Note though, that payment of the government-imposed taxes and fees of no more than $80 for roundtrip domestic flights (for itineraries with up to four flight segments) is required. Baggage charges and other restrictions apply. See terms and conditions for details.

One of the factors you won’t have to worry about is your miles expiring – they don’t. Additionally, you’ll be able to check your first bag for free. Plus, you can get to your seat sooner thanks to Main Cabin 1 Priority Boarding.

Welcome Bonus

New Delta SkyMiles® Platinum Business American Express Card cardholders can earn 60,000 Bonus Miles after spending $3,000 in purchases on their new Card in their first 3 months of Card Membership.

Additionally, save 15% On Award Travel With TakeOff 15. Eligible Card Members now enjoy exclusive savings on Delta flights. Not applicable to partner-operated flights or to taxes and fees.

The annual fee is $250 (See Rates & Fees).

Delta SkyMiles Reserve Business American Express Card

Premium travelers will enjoy the Delta SkyMiles® Reserve Business American Express Card because of the card benefits.

For one, cardholders can enjoy a Domestic First Class, Delta Comfort+®, or Main Cabin round-trip companion certificate each year upon renewal of their Delta SkyMiles Reserve Business Card. Note that payment of the government-imposed taxes and fees of no more than $80 for roundtrip domestic flights (for itineraries with up to four flight segments) is required. Baggage charges and other restrictions apply. See terms and conditions for details.

With Status Boost®, earn 15,000 Medallion Qualification Miles (MQMs) after you spend $30,000 in purchases on your Card through 12/31/23, up to four times per year getting you closer to Medallion Status.* MQMs are used to determine Medallion Status and are different from the miles you earn towards flights.*Effective 1/1/24, this benefit will no longer be available, and there will be a new way to earn toward Medallion Status with the Card. Learn more.

The Main Cabin 1 Priority Boarding allows cardholders to get settled in their seats sooner.

But that’s not all. You can also earn 3x SkyMiles on direct eligible Delta purchases.

Additional Perks

With complimentary access into Delta Sky Club®, you can relax before your Delta flight, or find downtime between connections.* You’ll also receive two Delta Sky Club One-Time Guest Passes each year so you can share the experience with others when you’re traveling together. *Effective 2/1/25, Reserve Card Members will receive 15 Visits per year to the Delta Sky Club; to earn an unlimited number of Visits each year starting on 2/1/25, the total eligible purchases on the Card must equal $75,000 or more between 1/1/24 and 12/31/24, and each calendar year thereafter. Once all 15 Visits have been used, Eligible Card Members may purchase additional Delta Sky Club Visits (including Grab and Go) at a per-visit rate of $50 per person using the Card.

When you purchase a Delta flight with your Delta SkyMiles Reserve Card, you will receive complimentary access to The Centurion® Lounge or Escape Lounge – The Centurion® Studio Partner.

After you spend $150,000 on your Card in a calendar year, you earn 1.5 Miles per dollar (that’s an extra half mile per dollar) on eligible purchases the rest of the year. If your purchase qualifies for a category that has a higher mileage accelerator, only the higher accelerator will apply (ex: you would earn 3X miles on purchases made directly with Delta instead of 1.5X).

Additionally, save 15% On Award Travel With TakeOff 15. Eligible Card Members now enjoy exclusive savings on Delta flights. Not applicable to partner-operated flights or to taxes and fees.

New Delta SkyMiles® Reserve Business American Express Card cardholders can earn 70,000 Bonus Miles after spending $5,000 in purchases on their new Card in their first 3 months of Card Membership.

Cardholders also don’t have to worry about foreign transaction fees (See Rates & Fees) when they spend abroad. The annual fee is $550 (See Rates & Fees).

Is It Worth Getting a Delta Credit Card

Yes, it’s worth getting a Delta credit card if you fly on Delta Air Lines especially if you check your bags regularly. If you don’t fly Delta on a regular basis or you’re not near a Delta hub you will most likely be better off with a travel credit card that earns transferrable points.

Summary of the Best Delta Credit Cards 2023

American Express and Chase will be your two most Delta-friendly travel credit card issuers. For convenience and Delta travel benefits the co-brand cards will be your best option. If you aren’t set on earning Delta SkyMiles with every purchase, there are some of the best travel rewards credit cards to choose from as well.

Avoid Paying Baggage Fees on Delta Air Lines Flights

Bag fees are about as annoying as stubbing your toe in the middle of the night, which unfortunately happened to me last night. Airlines don’t find bag fees annoying though, and just a couple of years ago, Delta put $833 million in bags fees into their pockets. Cha-ching.

Delta is actually hoping to get to a billion! I’m tied to flying Delta, and I don’t like paying fees, so I carry the Delta SkyMiles® Gold American Express Card. The Delta SkyMiles Gold American Express Card comes with a built-in free checked bag benefit. And you can use your free checked bag perk for up to 8 people if they are traveling on the same itinerary on Delta flights.

The free checked bag perk on the Delta Gold card is great for those Delta flyers who don’t hold elite status with Delta Air Lines but fly with them on a frequent or infrequent basis.

To receive your free checked bag benefit, you just need to have your Delta SkyMiles® Gold American Express Card in good standing and be flying on a Delta flight. Just make sure that you put your Delta SkyMiles membership number on your reservation. Easy.

Check Out the $0 Annual Fee Delta SkyMiles Blue American Express Card

The Delta SkyMiles® Blue American Express Card earns SkyMiles on every purchase.

It earns 2x miles per dollar at restaurants worldwide, plus takeout and delivery in the U.S. Additionally, earn 2x miles per dollar spent on Delta purchases and 1x mile on all other eligible purchases. Plus, you can Pay with Miles: take up to $50 off the cost of your flight for every 5,000 miles you redeem with Pay with Miles when you book on delta.com.

In addition to earning bonus SkyMiles, you will also be awarded a 20% statement credit for Delta in-flight purchases for food and beverages.

The statement credit will be awarded on the same billing statement. There are no annual earning limits and your SkyMiles will never expire provided your Delta credit card account remains active. Your Delta SkyMiles can be redeemed for award flights starting at 5,000 miles per flight.

Enjoy 10,000 Bonus SkyMiles

New Delta SkyMiles® Blue American Express Card cardholders can earn 10,000 bonus miles after spending $1,000 in purchases on their new Card in their first 6 months.

This is a very reasonable spending requirement.

In recent years, airlines have placed more emphasis on the “race to the top” to attract and retain the most loyal customers. Now, they have realized young professionals are becoming a larger travel demographic as their careers flourish, and they have a disposable income to spend on air travel. The only catch is that these same travelers (and cost-conscious Gen-Xers) want to earn bonus airline miles without paying an annual credit card fee.

Major U.S. carriers have recently begun introducing $0 annual fee rewards cards to meet the needs of budget-savvy and periodic travelers. The Delta SkyMiles Blue American Express Card has a $0 annual fee (See Rates & Fees).

What the Delta SkyMiles Blue American Express Card Doesn’t Offer

If you currently own a Delta rewards card and are considering downgrading to the Blue Delta Amex, you might want to think twice.

The Amex Blue Delta is ideal for earning miles without paying an annual or foreign transaction fee (See Rates & Fees).

But since you won’t pay an annual fee with the Delta SkyMiles® Blue American Express Card, you won’t enjoy the following benefits:

- Free checked bags

- Priority boarding

- Discounted Delta SkyClub access

- Medallion Qualification Miles

If you fly Delta frequently, you might want to go for a Delta card with an annual fee that comes with more benefits.

Should You Get the Delta SkyMiles Blue American Express Card?

The Delta SkyMiles Blue American Express Card is intended for occasional Delta passengers who currently use a $0 annual fee cash back rewards card as their primary credit card. With a 2% rewards rate on all direct Delta purchases and worldwide dining, these same casual travelers can earn rewards flights sooner. And, it can get their feet wet as they enter the travel rewards arena.

Earn Miles With Amex Delta Credit Cards Offers

You can earn plenty of miles and other benefits with the Delta credit cards. Here are a couple of options to consider.

Delta SkyMiles Gold American Express Card

With the Delta SkyMiles® Gold American Express Card, you can earn a welcome bonus that can upgrade your travel.

Plus, Gold card members will receive a $100 Delta Flight Credit after spending $10,000 in purchases on their card in a calendar year. Cardholders can use the Credit for future travel.

You get priority boarding on Delta flights plus Main Cabin 1 Priority Boarding.

The Delta SkyMiles Gold Credit Card earns 2x Miles on Delta purchases at restaurants worldwide (including takeout and delivery in the U.S.) and at U.S. supermarkets (1x Mile for everything else that is eligible). It also has 20% savings in the form of a statement credit after you use your Card on eligible Delta in-flight purchases of food, beverages, and audio headsets.

Additionally, you can Pay with Miles: take up to $50 off the cost of your flight for every 5,000 miles you redeem with Pay with Miles when you book on delta.com.

Welcome Bonus

New Delta SkyMiles® Gold American Express Card cardholders can earn 40,000 bonus miles after they spend $2,000 in purchases on their new Card in their first 6 months.

The Delta SkyMiles Gold American Express Card also has very good perks when you fly on Delta metal. For starters, with Priority Boarding, you can get that coveted overhead bin space and into your seat before the rest of the passengers. Additionally, you can check your first bag for free on every Delta flight.

Delta SkyMiles Platinum American Express Card

The personal Delta SkyMiles® Platinum American Express Card has the ability to earn a nice welcome offer.

New Delta SkyMiles® Platinum American Express Card cardholders can earn 50,000 bonus miles after spending $3,000 in purchases on their new Card in their first 6 months.

Get access to Delta Sky Club® at a rate of $50 per person per visit for you and up to two guests or immediate family when traveling on a Delta flight from now until 12/31/23. Effective 1/1/24, this benefit will no longer be available.

Plus, earn up to 20,000 Medallion® Qualification Miles (MQMs) with Status Boost® per year. After you spend $25,000 in purchases on your Card in a calendar year, you can earn 10,000 MQMs up to two times per year, getting you closer to Medallion® Status. MQMs are used to determine Medallion® Status and are different than miles you earn toward flights.

You also earn 3x Miles on Delta purchases and purchases made directly with hotels, 2x Miles at restaurants worldwide, plus takeout and delivery in the U.S. and at U.S. supermarkets. Earn 1x Miles on all other eligible purchases.

Additional Perks

Plus, enjoy your first checked bag free on Delta flights plus Main Cabin 1 Priority Boarding.

A Domestic Main Cabin round-trip companion certificate is also yours annually upon the renewal of your card. However, payment of the government-imposed taxes and fees of no more than $75 for roundtrip domestic flights (for itineraries with up to four flight segments) is required. Baggage charges and other restrictions apply. See terms and conditions for details.

Plus, cardholders get a fee credit for Global Entry or TSA PreCheck. Fee Credit for Global Entry or TSA PreCheck® after you apply through any Official Enrollment Provider. If approved for Global Entry, at no additional charge, you will receive access to TSA PreCheck.

Other perks of the personal Platinum and Gold Delta cards include free checked bags on Delta flights and priority boarding. The annual fee for this card is $250 (See Rates & Fees).

Redeeming Delta SkyMiles

A good perk of the Delta SkyMiles cards is that they are a transfer partner of American Express Membership Rewards points. That can be handy if you need to add to your Delta SkyMiles account for an upcoming trip. Delta SkyMiles can be painful to deal with since they often make changes overnight and don’t publish an award chart, but you can still use them to fly domestically and internationally on their metal or a SkyTeam partner.

Other benefits of the Delta SkyMiles program are the ability to book one-way flights starting at 5,000 miles, and no close-in booking fees, which has helped me save money in a crunch.

Examples of Redeeming Delta SkyMiles for Flights

Delta’s SkyMiles program is one of the most popular rewards programs for frequent flyers even though using their miles can be hit or miss, especially since they don’t publicly publish an award chart. But you can still use Delta SkyMiles to fly the world.

Whether you’re traveling with a family of four or just a party of one on business, there’s nothing to the process of making a reservation. Check out these good and bad examples of Delta award bookings.

Domestic Delta SkyMiles Options

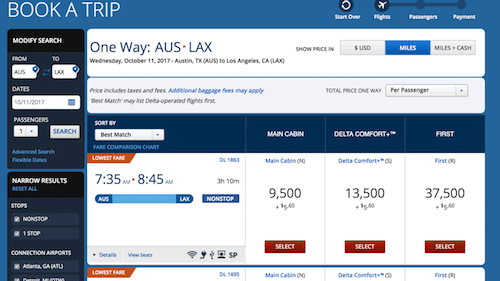

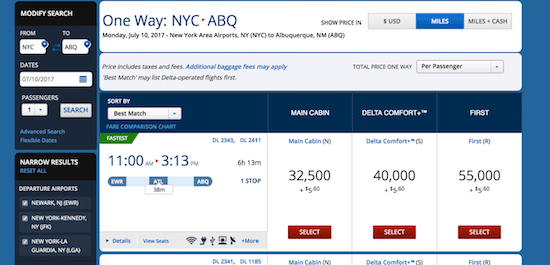

Travel to any domestic destinations in Alaska and the Continental US begins at 5,000 miles on one-way tickets, but you’re most likely going to find Delta domestic awards in the range of 7,500 SkyMiles – 12,500 SkyMiles one-way. The domestic Delta hubs and key markets are Atlanta, Boston, Detroit, Los Angeles, Minneapolis/St. Paul, New York-JFK, New York-LaGuardia. I prefer and recommend trying to keep domestic economy awards under 25,000 miles round-trip.

But Delta won’t always have the deals you’re looking to book. For example, if you and one companion are traveling from New York to Albuquerque in July of this year, totals can range from 32,500 miles to 60,000 miles one-way.

Tip: The site always lists the lowest fare or fares in red! They may include more connections, but the value often outweighs any inconveniences.

Once you select a fare, the site will list your fastest option as well as the lowest fare. Connecting airports and selected upgrades are also featured on the page. As with any rewards program, a number of miles to book the Delta One/First cabin is significantly higher than other levels.

Travelers who are cautious about using their miles or flyers without the necessary number for their trip can also pick the miles and cash features. This will give you the chance to pay for part of the flight and reduce miles necessary to complete the ticket.

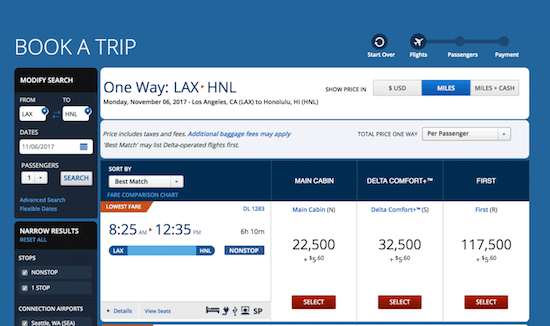

Using Delta SkyMiles for Award Flights to Hawaii

Award flights to Hawaii can exceed 100,000 miles. Delta One/First Cabin totals have been known to reach over 200,000 miles. Ouch.

Tip: You can knock down miles spent to domestic numbers if you’re willing to use the miles and cash option. Be prepared to pay more than you planned, but substantially less than you would pay on an average ticket for the same flight. I would prefer to fly to Hawaii in economy class for only 22,500 miles each way.

Whether you’ve chosen domestic travel in the continental US, Alaska, or Hawaii, your last screen before the confirmation will be the same. Take note that your departure and return flights match the quoted rates. It’s also important to note how many stops you’ll encounter along the way.

International Flights

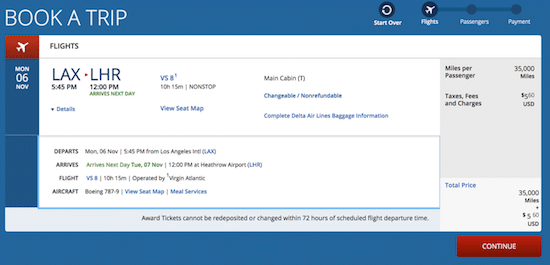

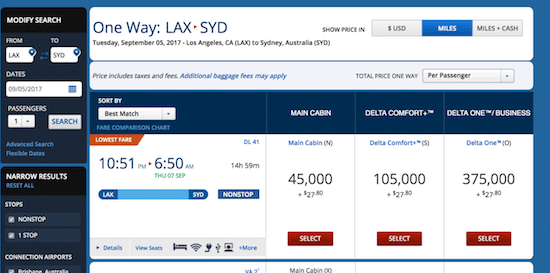

Redeeming Delta SkyMiles for international flights can often seem tricky compared to their domestic counterparts. It can be bad, but not always. For example, seats on a standard non-stop one-way flight from Los Angeles to London in July can be found for 35,000 miles and $5.60 on their partner, Virgin Atlantic.

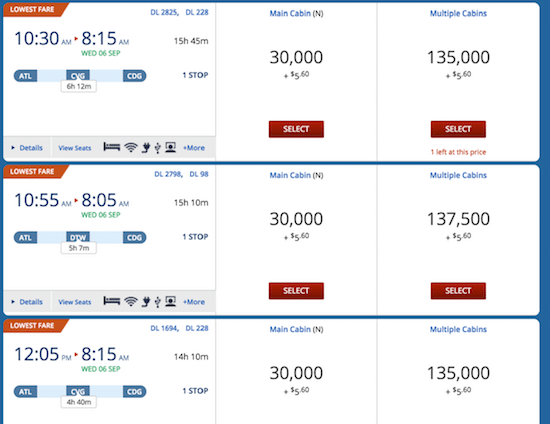

Another example is to fly for 30,000 miles one way to Europe like from Atlanta to Paris:

Tip: Try booking one leg of the journey at a time. You may save on the trip and find a better flight that will meet the time and day you wanted to travel. Picking flexible dates helps the system find flights that limit the number of miles needed for round trip journeys.

Delta Partner Airlines

Partner airlines are an important part of the Delta SkyMiles program. Delta is a part of the SkyTeam alliance so you can use Delta SkyMiles to fly any airline in the same alliance. For example, Virgin Australia flights can be booked with Delta SkyMiles.

Who doesn’t love award travel? People all over the world are looking towards rewards programs to help them make the most out of every excursion. With so many frequent flyer programs out there, it’s hard to keep up with how to maximize bookings. Delta’s SkyMiles program offers a range of options for frequent flyers, but does have some limitations, and can be frustrating.

I still accumulate Delta SkyMiles, so I have flexibility. It’s also worth mentioning that you can transfer in American Express Membership Rewards to Delta SkyMiles and that there are no close-in booking fees for Delta awards. That’s nice!

5 Tips to Help You Redeem Your Delta SkyMiles

When trying to redeem miles earned with Delta, there are lots of things you should keep in mind before throwing your hands up in the air. Yes, surely, you will throw your hands up in the air at some point. Delta.com is notoriously bad when it comes to searching for partners, and despite a recent revamp to the search engine adding partners like Aerolineas Argentinas, China Southern, Gol, and Virgin Atlantic, there are still loads of problems.

The airline was a total dud at a Freddie Awards event, which was hosted in Delta’s own heritage museum in Atlanta. Frequent travelers vote on their favorite programs, which in turn win Freddies based upon their popularity. Despite the event being in hometown Atlanta, Delta won an embarrassing zero awards.

According to those who attended the events, Delta staff involved with SkyMiles were not expecting to win anything.

It’s not all bad…

SkyMiles can be extremely valuable, but only if your plans are flexible. With the most recent mileage program adjustments, Delta seems to have tightened up the award space for most travelers (despite touting the opposite). Most of the cheapest awards are only available 21 days in advance these days (you won’t find that restriction in any of their promotional materials).

Want to fly 25,000 miles roundtrip (as advertised by annoying inflight announcements and constant in-terminal irritations)? Good luck; they are very difficult to find. On the opposite end of the spectrum, Delta has recently touted one-way flights as low as 5,000 or 10,000 miles, but they are extremely restrictive to certain routes like intra-California, for example. They are there, but it takes a magician to find them sometimes.

Here are five tips to help you get around Delta.com’s quirky website and redeem your SkyMiles:

1. No matter what the airline, begin your search by looking for space segment by segment.

You would be surprised how much more availability you will discover if searching this way. The only caveat is that Delta imposes a restriction known as journey control. This means that if you find space from Boston to Atlanta and Atlanta to Lima independently, it may not be there if you search for it as a Boston to Lima award.

Delta employs this limitation (as it does for revenue tickets) on many routes, and it can sometimes cause a snafu for your travel plans. Still, the best way to begin searching for award space is to look segment by segment.

2. Despite saying that delta.com shows availability for partners online, it still is not always there.

Delta.com is very selective as to what it shows you. For example, search for Houston to Amsterdam and the website will show you connections through Atlanta and Detroit, but ignore the nonstop on KLM. Beware. Verify availability by calling Delta.

The website likes to show off more expensive itineraries, so keep scrolling down for cheaper options. If you don’t find the partner you are looking for, call Delta to check on availability.

3. Delta has a unique partnership with Virgin Atlantic; it is supposed to be a joint venture, but good luck.

Tickets don’t issue properly; delta.com cannot issue tickets easily with this partner. With that said, Virgin Atlantic availability is surprisingly better than Delta’s and it often appears on delta.com. Search for a Virgin flight from one of their gateways (LAX, SFO, JFK, EWR, ATL, MCO, MIA among others) to Heathrow or Gatwick.

For some reason, delta.com does not always allow you to successfully ticket itineraries from North America to Europe using SkyTeam partners efficiently. Your best bet? Find the long-haul segment first, and then call Delta to ask about connections on either end.

4. Still looking for award space? Call Delta to ask them specifically for your airline of choice and mention segment by segment your itinerary.

So if you are traveling Madrid to Saigon; don’t leave agents to do their own search. They will say: we have nothing. You need to guide them that Air Europa and Air France fly to the Vietnam Airlines gateways out of Frankfurt or Paris to connect onward. It seems we are all geography students schooling the agents these days.

5. Mixing partners is best via phone.

If you want to make a simple, one-airline booking, then delta.com may work. Additionally, if you are trying to mix award partners, it is best to call Delta directly. If you cannot book it easily online, Delta most often waives the phone booking fee for these types of complicated partner awards.

For those not familiar, Delta has some great partners that allow for exotic itineraries including Aeroflot, Alitalia, Gol (Brazil), Kenya Airways, Virgin Atlantic, and Virgin Australia among many others.

4 Best Delta Air Lines Credit Cards For 2023

Using Delta Air Lines credit cards is one of the easiest ways to maximize your SkyMiles membership. Not only can you earn SkyMiles on your purchases, but you also earn additional travel benefits, depending on your card. If you fly on Delta on a consistent basis, using a Delta-friendly credit card can help you book a free flight more often. Read on to learn more.

Co-Brand Delta Air Lines Credit Cards

American Express currently offers four different personal Delta Air Lines credit cards that fit every travel style. The annual fee for these four cards ranges from $0 to $450. Each card offers incrementally more benefits. Note that Delta credit cards have some of the most generous checked baggage benefits among airline credit cards.

We’ll list these four Delta credit cards in order of increasing annual fee.

Delta SkyMiles Blue American Express Card

Ideal for Travelers That Don’t Check Baggage

The main reason to get the Delta SkyMiles® Blue American Express Card is to skip the annual fee (See Rates & Fees). You might use this credit card to build a credit history or as a secondary credit card to maximize your Delta Air Lines purchases. A third benefit is that your Delta SkyMiles never expire if you own this card.

Since this card doesn’t charge an annual fee, you’re not going to receive the additional card benefits like free checked bags. But if you never check a bag, this card can save you $95 a year and still earn SkyMiles on eligible purchases.

But, its purchase rewards are just as valuable (arguably more valuable) as the other Delta credit cards.

It earns 2x miles per dollar at restaurants worldwide, plus takeout and delivery in the U.S. Additionally, earn 2x miles per dollar spent on Delta purchases, and 1x mile on all other eligible purchases. Plus, you can Pay with Miles: take up to $50 off the cost of your flight for every 5,000 miles you redeem with Pay with Miles when you book on delta.com.

Welcome Bonus

New Delta SkyMiles® Blue American Express Card cardholders can earn 10,000 bonus miles after spending $1,000 in purchases on their new Card in their first 6 months.

The other co-brand Delta credit cards only offer double miles on Delta purchases. However, if you don’t check bags or visit the Delta SkyClub, this is the best option.

Get a 20% statement credit on select Delta in-flight purchases.

Delta SkyMiles Gold American Express Card

Ideal for Travelers Who Regularly Check Bags

For most casual Delta flyers, the Delta SkyMiles® Gold American Express Card will be your best option. The reason why is that the first checked bag flies free on Delta flights for you and up to 8 passengers.

You get priority boarding on Delta flights plus Main Cabin 1 Priority Boarding.

The Delta SkyMiles Gold Credit Card earns 2x Miles on Delta purchases at restaurants worldwide (including takeout and delivery in the U.S.) and at U.S. supermarkets (1x Mile for everything else that is eligible). It also has 20% savings in the form of a statement credit after you use your Card on eligible Delta in-flight purchases of food, beverages, and audio headsets.

Additionally, you can Pay with Miles: take up to $50 off the cost of your flight for every 5,000 miles you redeem with Pay with Miles when you book on delta.com.

Welcome Bonus

New Delta SkyMiles® Gold American Express Card cardholders can earn 40,000 bonus miles after they spend $2,000 in purchases on their new Card in their first 6 months.

If you don’t check enough baggage or fly often, you should try the $0 annual fee Blue Delta SkyMiles. However, if you can use the free checked baggage and want the convenience of priority boarding, try this card.

Plus, Gold card members will receive a $100 Delta Flight Credit after spending $10,000 in purchases on their card in a calendar year. Cardholders can use the Credit for future travel.

The introductory annual fee of $0 for the first year, then $99 (See Rates & Fees).

Delta SkyMiles Platinum American Express Card

Ideal For Travelers Wanting a Companion Certificate

With the Delta SkyMiles® Platinum American Express Card, you can enjoy several card benefits such as the annual companion certificate you receive each card anniversary. With this certificate, you receive a domestic main cabin round-trip ticket for your travel companion.

You will have to pay up to $75 in fees and taxes for the round-trip domestic fare (for itineraries with up to four flight segments). Baggage charges and other restrictions apply.

You also earn 3x Miles on Delta purchases and purchases made directly with hotels, 2x Miles at restaurants worldwide, plus takeout and delivery in the U.S. and at U.S. supermarkets. Earn 1x Miles on all other eligible purchases.

Plus, enjoy your first checked bag free on Delta flights plus Main Cabin 1 Priority Boarding.

In addition to these card perks, you also enjoy these Delta benefits:

- Up to 9 free checked bags on Delta flights

- Priority Boarding

- Discounted SkyClub Access

- Fee credit for Global Entry or TSA PreCheck

- Terms apply

Welcome Bonus

New Delta SkyMiles® Platinum American Express Card cardholders can earn 50,000 bonus miles after spending $3,000 in purchases on their new Card in their first 6 months.

Get access to Delta Sky Club® at a rate of $50 per person per visit for you and up to two guests or immediate family when traveling on a Delta flight from now until 12/31/23. Effective 1/1/24, this benefit will no longer be available.

Earn 10,000 Medallion® Qualification Miles (MQMs) after you spend $25,000 in purchases on your Delta Platinum Card, up to two times through 12/31/23. Effective 1/1/24, this benefit will no longer be available, and there will be a new way to earn toward Medallion Status with the Card. Learn more at delta.com/skymilesprogramchanges.

Fee Credit for Global Entry or TSA PreCheck® after you apply through any Official Enrollment Provider. If approved for Global Entry, at no additional charge, you will receive access to TSA PreCheck.

Delta SkyMiles Reserve American Express Card

Ideal for First Class Passengers and Free SkyClub Access

If you want full access to the SkyMiles and Sky Club program, look no further than the Delta SkyMiles® Reserve American Express Card. It definitely caters to the finer things in life.

Cardholders can receive a Domestic First Class, Delta Comfort+®, or Main Cabin round-trip companion certificate each year upon renewal of their Card. *Payment of the government-imposed taxes and fees of no more than $80 for roundtrip domestic flights (for itineraries with up to four flight segments) is required. Baggage charges and other restrictions apply. See terms and conditions for details.

Eligible Card Members get 15% off when using miles to book Award Travel on Delta flights through delta.com and the Fly Delta app. Discount not applicable to partner-operated flights or to taxes and fees.

You also get a fee credit for TSA PreCheck or Global Entry. Fee Credit for Global Entry or TSA PreCheck® after you apply through any Official Enrollment Provider. If approved for Global Entry, at no additional charge, you will receive access to TSA PreCheck.

Enjoy your first checked bag free on Delta flights.

Cardholders also earn 3x miles on Delta purchases and 1x miles on all other eligible purchases.

Welcome Bonus

New Delta SkyMiles® Reserve American Express Card cardholders can earn 60,000 bonus miles after spending $5,000 in purchases on their new Card in their first 6 months.

With Status Boost®, earn 15,000 Medallion Qualification Miles (MQMs) after you spend $30,000 in purchases on your Card through 12/31/23, up to four times per year getting you closer to Medallion Status. MQMs are used to determine Medallion Status and are different from the miles you earn towards flights. Effective 1/1/24, this benefit will no longer be available, and there will be a new way to earn toward Medallion Status with the Card. Learn more at delta.com/skymilesprogramchanges.

Enjoy Delta Sky Club® access at no cost and bring up to two guests or immediate family at a rate of $50 per person per visit. Effective 2/1/25, Reserve Card Members will receive 15 Visits per year to the Delta Sky Club; to earn an unlimited number of Visits each year starting on 2/1/25, the total eligible purchases on the Card must equal $75,000 or more between 1/1/24 and 12/31/24, and each calendar year thereafter.

The annual fee for this card is $550 (See Rates & Fees).

Other Travel Rewards Cards to Consider

If you don’t need the bonus SkyMiles opportunities or free checked bags, you might also consider getting a flexible travel rewards card instead of a Delta Air Lines credit card. Choose one that lets you transfer points on a 1:1 basis to Delta when possible.

The Platinum Card from American Express

Ideal for 1:1 point transfers and Delta SkyClub lounge access

The best flexible rewards card for Delta Air Lines is The Platinum Card® from American Express. You can enjoy these benefits:

- Earn 5x Membership Rewards® Points for flights booked directly with airlines or with American Express Travel, up to $500,000 on these purchases per calendar year

- 1:1 point transfers to Delta (and other frequent flyer programs)

- Up to $200 annual air travel statement credits for incidental fees at one qualifying airline (in the form of a statement credit; enrollment required)

- Delta Sky Club access

- Prepaid hotels booked with American Express Travel earn unlimited 5x points

If Delta isn’t your primary airline, or you want to earn 5x points instead of 2x points on Delta ticket purchases, the Amex Platinum is the best option to quickly rack up frequent flyer miles. When you’re ready to book a Delta award flight, you can transfer your points on a 1:1 basis.

Welcome Bonus

New The Platinum Card® from American Express cardmembers can earn 80,000 Membership Rewards® points after spending $8,000 on purchases on their new Card in the first 6 months of Card Membership.

The annual fee is $695 (See Rates & Fees) but can be offset with the perks, which are valued at over $1,400.

How to Avoid the Delta Baggage Fees (And Still Fly Delta)

How do you avoid paying for your bags? Luckily, you have a few different options. The first four options will help you avoid the baggage fee if Delta is still your best flight option. You can find the most up-to-date information on Delta Air Lines baggage policy here.

Upgrade to a Better Cabin Class

These fee increases only apply to Basic Economy fares. You can simply avoid the fee by buying a more expensive ticket with one of the following cabin classes:

- Main Cabin

- Delta Comfort+

- First Class

- Delta Premium Select

- Delta One

In addition to avoiding the baggage fees, you can also have a more enjoyable flight experience and earn potentially more SkyMiles and Medallion Qualification Miles that can benefit you in the long run.

Pay With a Delta Credit Card

With the personal Delta credit cards or their business versions, the first checked bag for you and 8 passengers fly for free. That’s a potential $1,080 savings round-trip if all nine bags are checked. You’ll need to use one of the co-brand Delta credit cards that charge an annual fee. You can choose between the:

Personal Delta SkyMiles Credit Cards

- New Delta SkyMiles® Gold American Express Card cardholders can earn 40,000 bonus miles after they spend $2,000 in purchases on their new Card in their first 6 months.

- New Delta SkyMiles® Platinum American Express Card cardholders can earn 50,000 bonus miles after spending $3,000 in purchases on their new Card in their first 6 months.

- Also, New Delta SkyMiles® Reserve American Express Card cardholders can earn 60,000 bonus miles after spending $5,000 in purchases on their new Card in their first 6 months.

Business Delta SkyMiles Credit Cards

- New Delta SkyMiles® Gold Business American Express Card cardholders can earn 50,000 Bonus Miles after spending $2,000 in purchases on their new Card in their first 3 months of Card Membership.

- New Delta SkyMiles® Platinum Business American Express Card cardholders can earn 60,000 Bonus Miles after spending $3,000 in purchases on their new Card in their first 3 months of Card Membership.

- And new Delta SkyMiles® Reserve Business American Express Card cardholders can earn 70,000 Bonus Miles after spending $5,000 in purchases on their new Card in their first 3 months of Card Membership.

In addition to the waived baggage fees, you will also earn SkyMiles on every purchase made directly with Delta.

Pay With The Platinum Card from American Express

For a flexible travel rewards card, your best option can be The Platinum Card® from American Express. The $200 air travel credit covers your checked baggage fees. Once you land, you will also be able to skip the long security lines to pass through customs with Global Entry, thanks to the Amex Platinum fee credit.

In addition to enjoying TSA PreCheck or Global Entry access, cardholders can also enjoy CLEAR perks. Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card®.

Another reason to fly with the Amex Platinum is the complimentary Delta SkyClub access when flying Delta, or you can also relax at a Priority Pass (enrollment required) or a Centurion Lounge too.

Plus, American Express has expanded The Centurion® Network to include 40+ Centurion Lounge and Studio locations worldwide. Now there are even more places your Platinum Card® can get you complimentary entry and exclusive perks.

Fly Another Airline to Avoid the Delta Baggage Fees

Delta is already one of the more expensive airlines to fly whether you pay cash or SkyMiles for your ticket. Thankfully, you have a few other options to fly for less. You may decide to fly United Airlines, American Airlines, or Southwest (Southwest lets you check your first two bags for free).

Summary of the Best Delta Credit Cards in 2023

In conclusion, the best Delta credit cards in 2023 can help you earn miles more quickly while also enhancing your travel. Whether you’re a constant Delta flyer or the occasional traveler, there is an option for different lifestyles and travel goals. Which card is your favorite?

Personal Delta SkyMiles Credit Cards

- New Delta SkyMiles® Blue American Express Card cardholders can earn 10,000 bonus miles after spending $1,000 in purchases on their new Card in their first 6 months.

- New Delta SkyMiles® Gold American Express Card cardholders can earn 40,000 bonus miles after they spend $2,000 in purchases on their new Card in their first 6 months.

- And New Delta SkyMiles® Platinum American Express Card cardholders can earn 50,000 bonus miles after spending $3,000 in purchases on their new Card in their first 6 months.

- New Delta SkyMiles® Reserve American Express Card cardholders can earn 60,000 bonus miles after spending $5,000 in purchases on their new Card in their first 6 months.

Business Delta SkyMiles Credit Cards

- New Delta SkyMiles® Gold Business American Express Card cardholders can earn 50,000 Bonus Miles after spending $2,000 in purchases on their new Card in their first 3 months of Card Membership.

- New Delta SkyMiles® Platinum Business American Express Card cardholders can earn 60,000 Bonus Miles after spending $3,000 in purchases on their new Card in their first 3 months of Card Membership.

- And new Delta SkyMiles® Reserve Business American Express Card cardholders can earn 70,000 Bonus Miles after spending $5,000 in purchases on their new Card in their first 3 months of Card Membership.

Check out these articles for more in-depth reviews of travel credit cards:

- Chase Sapphire Preferred vs Capital One Venture Rewards Credit Card

- 7 Best Credit Cards for International Travel

- The Best Travel Credit Cards

For rates and fees of the Delta SkyMiles® Blue American Express Card, please click here.

For rates and fees of the Delta SkyMiles® Gold American Express Card, please click here.

And for rates and fees of the Delta SkyMiles® Platinum American Express Card, please click here.

For rates and fees of the Delta SkyMiles® Reserve American Express Card, please click here.

For rates and fees of Delta SkyMiles® Platinum Business American Express Card, please click here.

And For rates and fees of the Delta SkyMiles® Gold Business American Express Card, please click here.

For rates and fees of Delta SkyMiles® Reserve Business American Express Card, please click here.

For rates and fees of The Platinum Card® from American Express, please click here.

Very good blog, thank you so much for your effort in writing this post.

Thanks you as well; good effort and although I question the reduction of ‘bonus miles’ on my Delta Reserve card, I agree with all the perks you describe.

I can only comment by saying, as a frequent flyer to Asia from the USA, Delta was always the absolute highest # of points necessary, usually double what other carriers charged. Their website always showed the flights requiring the HIGHEST # of points, and when I used to call, the agents always did the same, never caring ,,and always seeking out the most exoensive. Plus, they were on a timer, so they would try to push the call as quick as possible. I’d have to call numerous times until finally finding a flight with lower points required (which they SOMETIMES had) but Delta has always left a bad taste in my mouth.

I agree, there are more valuable miles, but there’s still value in SkyMiles for some flights.